Trade: Call: CSCO Put: JOSB

Long:

CSCO: Usually considered conservative in it's guidance, CSCO has provided long term guidance of earnings growth at higher end of 10-15% with current estimates at 12%. In the coming quarters, we might expect CSCO to beat estimates. Technically the stock has overcome resistance at the 50-day MA and now that is acting like a support level

Short:

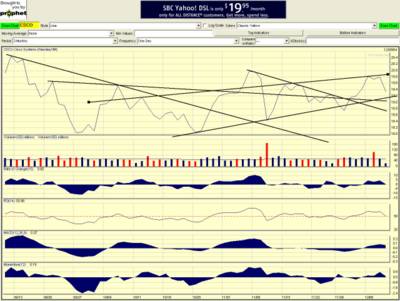

JOSB: Jos A Bank Clothiers Seems to have broken down technically. The 200-day MA which acted as support earlier is now showing resistance. I am also recently seeing a lot of their ads on CNBC, something that'll eat into their profits. They are relying heavily on holiday sales and if that doesn't meet expectations, there is a good chance of a breakdown. From the news, people have apparently been waiting for a drop in apparel prices

Trades:

CSCO: July $17.50 Call @2.85 CSCO was at 19.16

JOSB: July $25 Put @3.70 JOSB was at 24.8

JOSB chart

CSCO chart

1 Comments:

Whats up Pani, seems like you haven't been trading for some time

--

uday

Post a Comment

<< Home