Trades: AUO UNFI NIKU

I have been a combination of busy and lazy to write about trades this week. Here's a summary:

AUO: Bought AUO @13.10 (IRA)

UNFI: Bought UNFI @27.85 (Scottrade)

NIKU: Bought NIKU @18.83 (MB Trading)

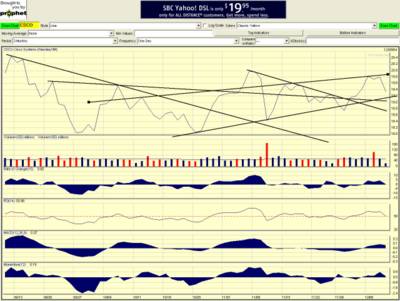

I have already written about AUO and UNFI. NIKU recently showed up on my volume surge screen and it was just breaking out of a cup-with-handle pattern. This kind of volume breakout usually signals short term strength in the stock. Also the stock broke out on a good earnings report, which is also a good sign.

I sold some of the losers in my portfolio SSFT and VITA to free up cash, for tax losses and to offset gains.

All the recent option trades Long: CSCO RHAT Short: JOSB MIK are moving opposite of my expected direction:

- CSCO and RHAT technicals are still strong.

- Weekly ROC for MIK has crossed above 0. MACD and Momentum indicators are still below 0. Weekly up volume has been below average so the up weeks are not be strong

- JOSB is still weak but closed up for the week in what appears to be a short term bounce.

- ERTS from my earlier put trade has turned totally opposite. It's hard to understand why there were recent upgrades on ERTS. The stock might have formed a climax top (3 continuous days of gaps up) although from some angles it looks like a breakout. I wont chase this stock anymore and hold my "near worthless" options till earnings. TTWO recently missed expectations despite the fact that it had the hit GTA-3 game and I expect ERTS to do the same.